Understanding and Managing Your Debt-to-Income Ratio: A Guide for Individuals and Families

Your debt-to-income (DTI) ratio is a crucial financial metric that measures the percentage of an individual’s or a family’s gross monthly income that goes toward paying debts. It is an essential tool for assessing your financial health and your ability to manage debt. Lenders often use the DTI ratio to determine your eligibility for loans, as it provides insight into your financial stability and risk level. Understanding your DTI ratio and how to manage it can help you achieve financial stability and meet your long-term financial goals.

What is a Debt-to-Income Ratio?

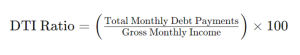

Your debt-to-income ratio is calculated by dividing your total monthly debt payments by your gross monthly income. The formula is:

- Total Monthly Debt Payments: This includes all monthly debt obligations such as mortgage or rent payments, credit card payments, student loans, car loans, personal loans, and any other recurring debt payments.

- Gross Monthly Income: This is your total income before taxes and other deductions. It includes wages, salaries, bonuses, pensions, and any other sources of income.

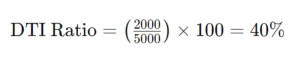

For example, if your total monthly debt payments amount to $2,000 and your gross monthly income is $5,000, your DTI ratio would be:

Why is the Debt-to-Income Ratio Important?

- Loan Approval: Lenders use the DTI ratio to evaluate your ability to manage monthly payments and repay debts. A lower DTI ratio suggests that you have a balanced debt load relative to your income, making you a less risky borrower.

- Financial Health Indicator: The DTI ratio helps you understand your financial health. A high DTI ratio indicates that a large portion of your income is going toward debt payments, which can strain your finances and limit your ability to save and invest.

- Budget Planning: Knowing your DTI ratio allows you to plan your budget more effectively, ensuring that you allocate a reasonable portion of your income to debt repayment and other financial goals.

Ideal Debt-to-Income Ratios

While ideal DTI ratios can vary, here are some general guidelines:

- 28/36 Rule: Many financial experts recommend that your housing expenses (including mortgage or rent) should not exceed 28% of your gross monthly income, and your total debt payments should not exceed 36%.

- 43% Threshold: The Consumer Financial Protection Bureau (CFPB) suggests that a DTI ratio above 43% may indicate that you could struggle to meet your debt obligations and manage other monthly expenses.

Steps to Calculate Your Debt-to-Income Ratio

- List Your Debts: Make a comprehensive list of all your monthly debt payments. Include mortgage or rent, car loans, student loans, credit card payments, personal loans, and any other recurring debt obligations.

- Calculate Your Gross Monthly Income: Add up all your sources of income before taxes and deductions. This should include your salary, bonuses, pensions, and any other regular income.

- Use the Formula: Divide your total monthly debt payments by your gross monthly income and multiply by 100 to get the percentage.

Strategies to Manage and Improve Your Debt-to-Income Ratio

- Pay Down Existing Debt: Focus on paying off high-interest debt first. This can reduce your monthly debt payments and lower your DTI ratio.

- Increase Your Income: Look for ways to boost your income, such as taking on a part-time job, freelancing, or seeking a raise at your current job.

- Refinance Loans: Consider refinancing high-interest loans to lower interest rates. This can reduce your monthly payments and help improve your DTI ratio.

- Avoid Taking on New Debt: Refrain from incurring additional debt until your DTI ratio is at a manageable level.

- Create a Budget: Develop a comprehensive budget to manage your expenses and allocate more funds toward debt repayment.

- Consolidate Debt: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and reduce your DTI ratio.

- Emergency Fund: Build an emergency fund to cover unexpected expenses, preventing you from incurring additional debt in emergencies.

Why do I care?

Understanding and managing your debt-to-income ratio is essential for maintaining financial health and achieving your long-term financial goals. By regularly monitoring your DTI ratio and implementing strategies to manage it effectively, you can improve your chances of loan approval, reduce financial stress, and create a more stable financial future for yourself and your family. Whether you are working towards paying off existing debts or planning to take on new financial commitments, keeping your DTI ratio in check is a critical step toward financial well-being.